Financial Literacy

Building a better understanding of your financial statements.

The financial statements of the organization are the written record of its operations and its history. These important documents describe the lifeblood of the financial operations of the organization and can be used as a basis for the planning of its future. Your organization’s financial literacy can be thought of as its ability to “read and understand” the critical financial statements of the organization.

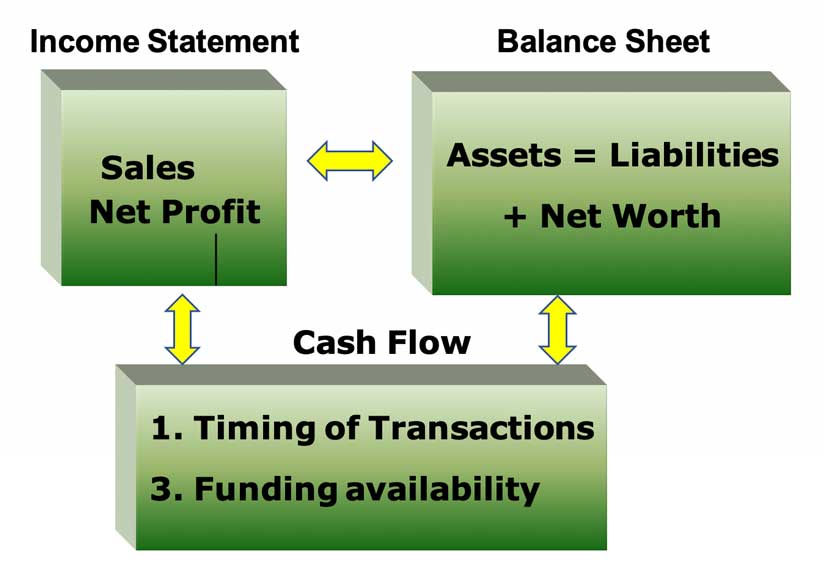

A more informed understanding of the financial structure and the financial operations of the organization can contribute to better decisions and improved management of the company’s operations. Likewise, an uninformed financial understanding can lead to poor decisions that lead to disappointments and possibly disastrous results. There are three documents that serve as the core foundation for your “financial literacy”. These three critical documents are: The Income Statement, the Balance Sheet, and the Cash Flow statement. Each individual document provides information on one aspect of the organization’s financial situation.

Each document provides information on an individual aspect of your organization’s financial operations and fiscal health. Together the set of documents can provide a valuable insight into how your organization is performing and how well it is situated in the competitive marketplace.

The Income Statement:

The Income Statement provides information on the revenues that have been earned in the current planning period and the presents the expenses and costs of providing and delivering the products and services to your customers. The surplus (or deficit) of the revenues compared to the expenses will be the profit, (or loss), of the organization. This view when examined will provide you with information on how well your organization is executing its functions in the marketplace. Are you doing the Right Things the Right Way?

The Balance Sheet:

The Balance Sheet provides information on assets you have in the organization and will give you an understanding of how you have paid for these assets. The importance of the Balance Sheet is in the understanding of how the assets you have in the business, your inventory, your plant and equipment and your working capital are positioned to support your targeted sales. With this understanding, the Liabilities Section will guide you in structuring the financial capabilities of your company to provide the capital and funds to pay for your assets. Do you have the Right Assets in place to support your organization? Have you paid for these assets with the Right Liabilities? Are you properly capitalized to support your targeted sales goals?

The Cash Flow Statement:

The Cash Flow Statement is an important and the most often overlooked component of the tool set to help in your Financial Literacy program. The Cash Flow statement provides a view of the linkages between the Income Statement and the Balance Sheet and with this view can provide a valuable insight into the time driven nature of the “flows of funds” in and out of the business. Is your working capital properly aligned with the Cash Flow cycle from your Inventories through your receivables and into the bank accounts? Does your business need to plan for seasonality in your operations or do you need to cope with long lead times between the first contact with the customer and the eventual receipt of the customers payment for the delivered goods and services.

Applicability of Financial Literacy to my business

Business owners and managers often ask; How does “Financial Literacy” apply to my business? I am a Not-For Profit Organization; does Financial Literacy apply to me?” Or, “I am a small business, I am the only employee; Does Financial Literacy apply to me?” Simply stated, every business needs to be able to understand its financial operations. The management of each and every business, large or small, one employee or hundreds of employees, must be able to understand the financial implications of its operational decisions and business practices.

Next Steps to Improving my organization’s “Financial Literacy”

The most important step in improving your organization’s financial literacy is the action of taking the first step. Any step is better than not moving forward. The Challenger Ventures Group offers two client focused programs to help organizations improve their financial literacy.

Navigating the Bermuda Triangle of corporate finance:

The Profit and Loss Statement, the Balance Sheet and the Cash flow statement can reveal a ready source of critical business intelligence hidden in the “Bermuda Triangle of corporate finance when examined by the CVG program in profitability management.

Profitability and Accountability: Profitability and Accountability:

Profitability is a strategic choice in the life of an organization. Strategic financial planning can provide a manageable path to sustained profitability. By aligning the organization’s operational activities with the financial realities of its performance. Accountability focuses on the examination of the drivers for performance and the assignment of measurable objectives for performance to specific responsibilities within the organization.